We take the risk out of your transactions, so you can safely grow your business.

What costs are involved?

If you think our services are expensive, you can quickly see for yourself exactly how KUKE’s solutions are priced.

Our specialists will tailor an individual offer to best suit your needs.

The problems we solve

- My customer failed to pay for goods I’ve delivered.

- I want to grow my exports but I’m concerned about crossing paths with unreliable business partners.

- I’ve come into some financial liquidity problems and I need rapid access to cash.

- I’m bidding for a tender and I don’t want to freeze any cash for collateral required by the customer.

How it works

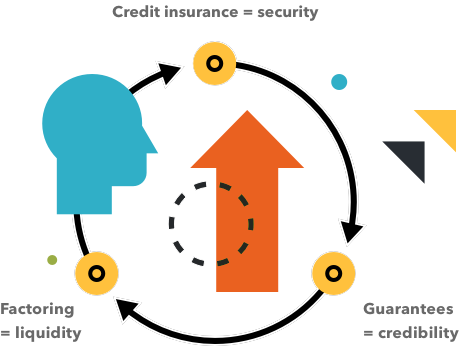

With KUKE, you no long have to worry about unpaid invoices or the shortage of cash. We offer solutions tailored to the specific nature of your business and we grow with you – in Poland and globally. We combine credit insurance, factoring, and guarantees to give you and your company the stability, security, and means to expand and grow your business.

Protection for your company

Financial stability as the foundation for growth

Forecasting future cash flows is crucial for every company. Smaller enterprises are particularly at risk of payment gridlocks. Sometimes even one outstanding invoice can compromise the financial liquidity of a small company. In fact, defaulting customers are already a problem for 7 out of 10 companies in Poland.* This is particularly important in exports. Smaller exporters find themselves in a more challenging environment amidst the complex maze of regulations and it is becoming increasingly difficult to collect outstanding receivables.

If you need support in trade risk management, at KUKE we offer a full range of solutions to comprehensively protect your business domestically and abroad. Credit insurance will provide your company with the security it needs. Thanks to factoring, you can speed up the flow of cash into your business account and improve your financial liquidity. If you take part in procurement procedures, our guarantees will constitute strong guarantees required by the investor.

*Intrum, European Payment Report 2020

A comprehensive solution

Why choose KUKE?

01

A simple service

Just like you, we work quickly and efficiently. Our services do not require the involvement of your time and resources. You can handle most operations related to insurance, guarantees or factoring online.

02

Support and cooperation

We’re experts in trade insurance and trade finance. We ensure constant monitoring of your buyers financial standing and assist you in collecting overdue payments.

03

Peace of mind

KUKE takes on your business risk and allows you to grow your business safely and securely. We will give you peace of mind and help you fulfil your business plans both in Poland and abroad.